CALIFORNIA—California gas prices may finally come down this year because the excise tax rate for gasoline in California may be lowered by 2.2 cents during The California State Board of Equalization (BOE) meeting that will take place in Culver City, on February 23.

According to the news release from the BOE’s Office of Public Affairs on February 12, if it gets adopted, the excise tax rate on gas will be 27.8 cents per gallon from July 1, 2016 through June 30, 2017. The current excise tax rate of 30 cents per gallon will remain effective until June 30, 2016.

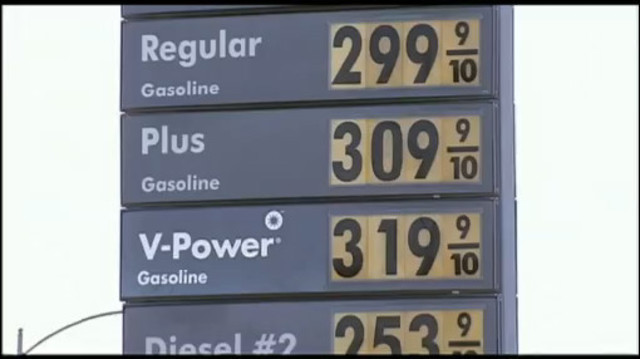

It has been a topic debated for a long time regarding gas prices in California being higher than other states in the country.

There are two types of state taxes on gas for California drivers: sales tax, which is a percentage of the price, and a per-gallon excise tax.

Before the “fuel tax swap” took effect in 2010, drivers were paying the full sales tax rate (which was 8.25 percent at the time), and an excise tax rate of 18 cents per gallon. The fuel tax swap lowered the sales tax rate on gas to 2.25 percent and requires the BOE to set a per-gallon excise tax rate before March 1 every year. This per-gallon excise tax rate needs to be carefully calculated so that drivers pay the same amount in overall taxes at the pump that they would have paid before the swap.

The excise tax rate takes into account a number of factors including: forecasted gas price, forecasted amount of gallons sold, sales tax revenue that would have been collected prior to the fuel tax swap, and tax revenue over- or under-collected in the prior fiscal year. The rate ensures that over a three-year period, drivers do not pay more or less in overall gas taxes than they would have prior to the swap.

From 2014 to 2015, the BOE collected nearly $5.4 billion in excise tax for the state’s Motor Vehicle Fuel Account, which helps pay for highways, roads and other public transportation projects. The sales tax on gasoline also helps fund a variety of state and local road programs.