UNITED STATES—On October 21 it was reported that over 43 members of 117th Congress are not in compliance with US tax laws for failure to disclose their stock transactions. According to reports, three members of the Congress failed to disclose their stock activity: Senator Tommy Tuberberville (R-AL), Rep. Blake Moore (R-UT), and Rep. Pat Fallon (R-TX). Rep. Cindy Axne (D-IA), Warren Davidson (R-OH), Nancy Pelosi (D-CA), Lance Goodan (R-TX), and Roger Williams (R-TX) are all on the House Financial Services Committee, and reportedly stand accused of non-compliance.

The Stop Trading On Congressional Knowledge of 2012 was enacted by Former President, Barack Obama to prevent insider trading by requiring lawmakers to report any stock activity made by themselves or their immediate family members.

The fine for breaking these laws is $200. Reports indicate that these fees have been waived by members of the 117th House Ethics Committee.

The lawmakers who remain in compliance are demanding stiffer penalties for those that refuse to comply. Following a stock transaction lawmakers have 30-45 days to report their activity and remain in compliance or be fined.

Senator Dianne Feinstein, 88, (D-CA) did not report her husband, Richard Blum’s purchase of between $100,000- $250,000 Facebook shares of stock this year. Blum reportedly sold $6 million of his Biotech stock in January 2020, all of which was not immediately disclosed.

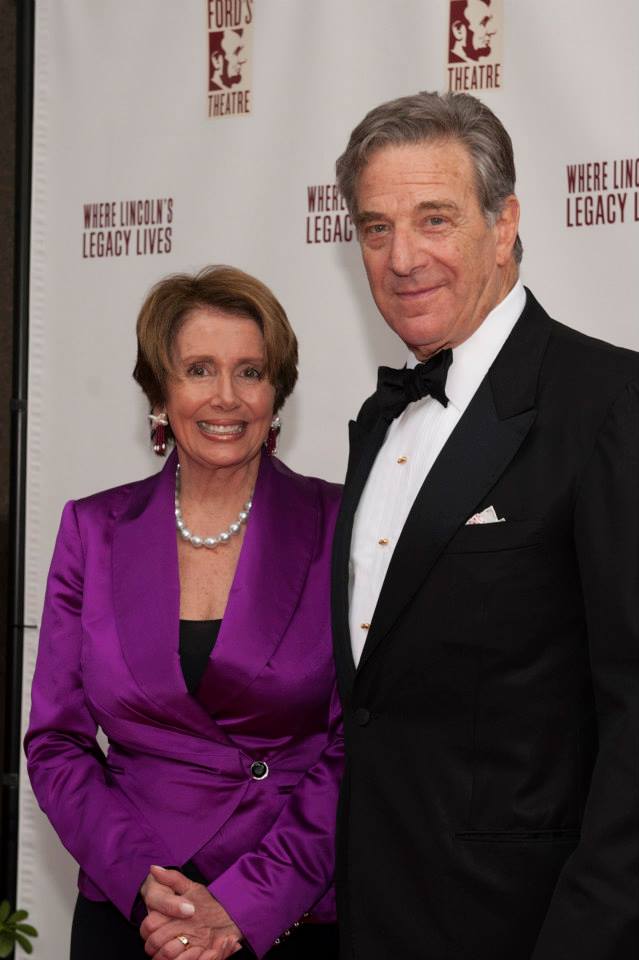

Pelosi came under scrutiny in July following an article in Bloomberg News accusing her husband Paul Pelosi of insider trading, making a profit of approximately $5 million contracts tied to Alphabet stock.

When asked by Bloomberg, Drew Hamill, spokesperson for Nancy Pelosi said, “The speaker has no involvement or prior knowledge of these transactions.” Fact-checkers say, Mr. Pelosi did not do anything illegal, but made, “one hell of a trade.”

The Campaign Legal Center confirms, they filed a complaint against Rep. Tom Suozzi (D-NY) who failed to disclose approximately 300 stock transactions.

Rep. Tom Malinowski (D-NJ) had multiple reporting violations in 2020 and 2021, and did not report until the oversight was brought to his attention.

Rep. Diana Harshbarger (R-TN), had over 700 stock trades worth over $10 million and also reportedly failed to comply.

Cynthia Lummis (R-WY) failed to file her disclosures on time after investing $100,000 in bitcoin. Senator Roger Marshall (R-KS) had a dependent child making the stock transactions that reportedly went unreported for nearly a year and a half.

Senator Mark Kelly (D-AZ), reportedly invested in the development of supersonic passenger aircraft, and was tardy in reporting his stock activity.