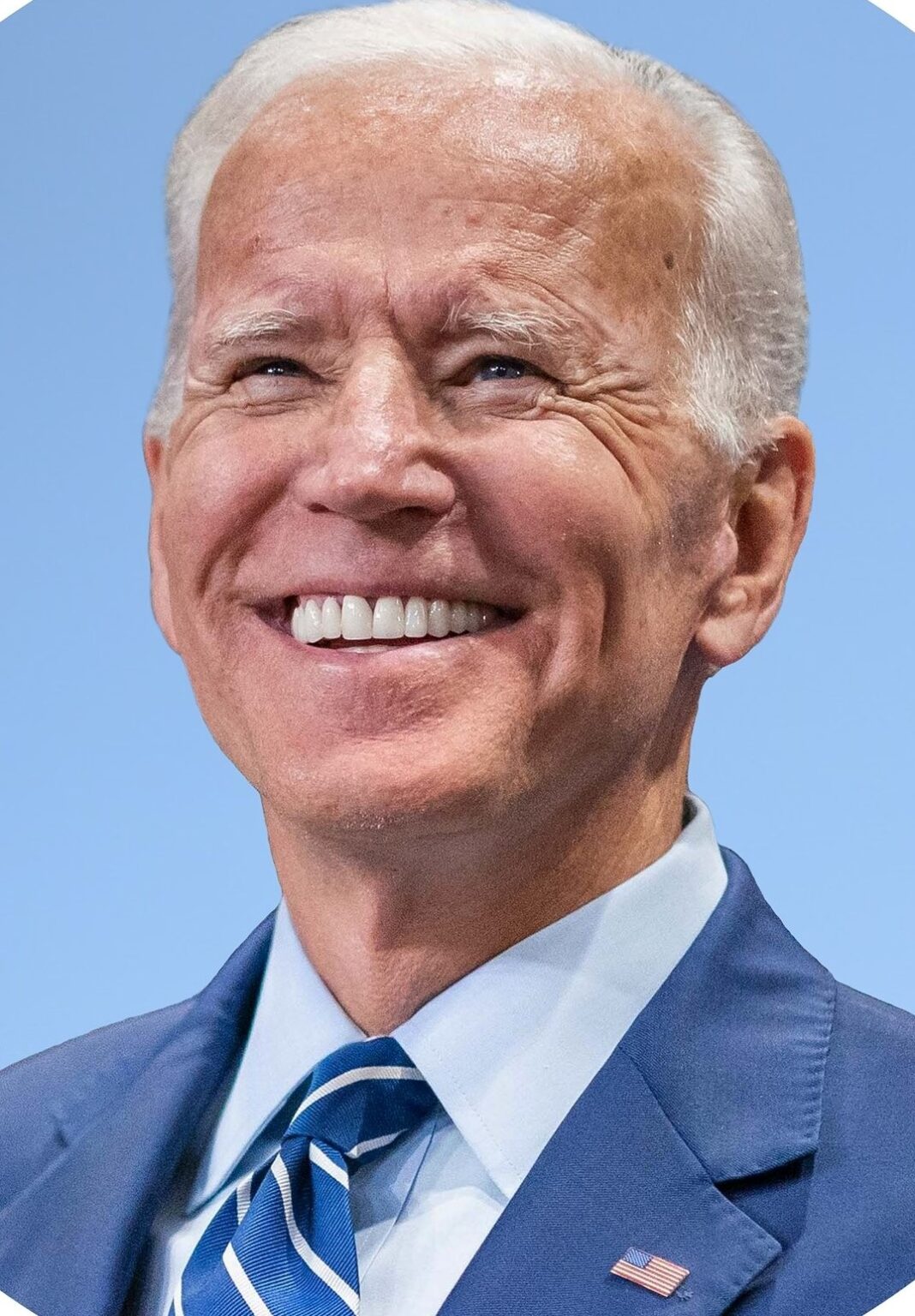

UNITED STATES—On August 16, President Biden signed the Inflation Reduction Act that includes provisions to reinstate previously revoked leases of 81 million acres of offshore oil and gas in the Gulf of Mexico.

This transaction created the largest oil and gas lease sale in U.S. history.

The Inflation Reduction Act has provisions to direct spending, tax credits, and loans to enable the use of solar panels, and special equipment to decrease pollution at coal and gas-powered factories.

The National Ocean Industries Association (NOIA) President, Erik Milito issued the following statement:

“The Inflation Reduction Act puts in place a framework for continued development of U.S. offshore oil and gas mechanisms to advance offshore wind, and incentives to spur offshore carbon sequestration innovation. No legislation is perfect, but IRA’s offshore energy provisions will enable continued investment in U.S. energy projects by an industry that is already solving, scaling, and deploying low carbon energy solutions.

We applaud the leadership of Senator Manchin and his team for shepherding this legislation from concept through enactment. We hope Congress can build on this by passing a bipartisan commonsense package of permitting reforms to fully realize our energy potential. NOIA stands ready to work to deliver on those efforts as well.”

In January 2022, the U.S District Judge of the District of Columbia, Rudolph Contreras ruled that the Bureau of Ocean Energy Management’s (BOEM) decision to proceed with the oil lease sale was “arbitrary and capricious.”

The Judge’s ruling initially blocked the Biden administration from proceeding with the sale. Biden did not appeal the Court’s decision.

By signing the Inflation Reduction Act into law, POTUS bypassed the ruling of Judge Contreras and revived the lease.

According to NOIA, to issue an offshore wind lease, oil and sale of 60 million acres must occur in the prior year and run for 10 years.

On July 22, the Institute of Energy Research (IER) reported the Biden Administration per the Department of Energy (DOE), sold China nearly one million barrels of oil from the U.S. Strategic Petroleum Reserve (SPR).

The DOE sold an additional 950,000 barrels to China for approximately $119 a barrel equaling $113 million.

On November 17, 2021, BOEM announced that the Gulf of Mexico Sale 257 generated $191,688,984 in high bids for 308 tracts covering 1.7 million acres in federal waters of the Gulf of Mexico.

BOEM reported multiple Lease Sales during the Trump Administration.

On August 21, 2019, in President Trump’s America First Offshore Energy Strategy, the Department of Interior Deputy Assistant Secretary for Land and Mineral Management announced the region-wide Gulf of Mexico Lease Sale 253.

Trump’s sale generated $159,286,761 in high bids for 151 tracts covering 835,006 acres in the Federal Waters of the Gulf of Mexico with 27 companies and $174,922,200 in bids.

In April 2022, the DOE sold 950,000 barrels of oil to China International United Petroleum & Chemicals Company Ltd. (UNIPEC). UNIPEC is China’s largest trading company.

Biden indicated the new act will advance environmental justice, lower energy costs, create jobs, tackle climate change, build better futures for young Americans, and help Latino, Black, and Tribal communities.