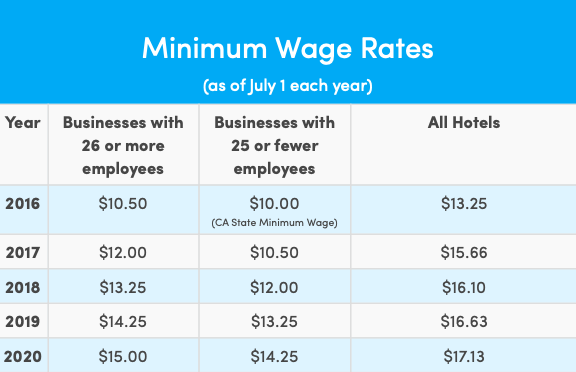

SANTA MONICA – Employers in the City of Santa Monica will raise the minimum wage rate on July 1st, 2020 to $15 to comply with updated provisions in the Citywide Minimum Wage Ordinance. For smaller businesses with a staff of 25 people or less, the hourly minimum wage rate will increase to $14.25. For hotel workers, the hourly minimum wage rate will increase to $17.13 to match the City of Los Angeles’ Citywide Hotel Worker Minimum Wage Rate.

Smaller businesses with less than 25 employees and qualifying nonprofits have an additional year to comply with the new law. The paid sick leave provision requires Santa Monica employers to provide small businesses with 40 hours of paid sick leave, and 72 hours of paid sick leave for larger businesses.

The updated Minimum Wage Ordinance also states that employees working for the first time in an activity in which they have no previous similar or related experience can earn no less than 85% of the minimum wage for the first 160 hours of employment.

Employers who collect service charges from customers must pay the entirety of those charges to the workers who performed those services. Service charges can be shared between front and back of house workers apart from hotel catering, porterage, and delivery charges. Healthcare surcharges must be spent entirely on workers and follow specific guidelines.

Service Charges are separately-designated amounts charged and collected by an employer from customers that is for service by employees. Services Charges are designated on receipts, invoices, or billing statements under the term “service charge,” “table charge,” “porterage charge,” “automatic gratuity charge,” “healthcare surcharge,” “benefits surcharge,” or similar language. Service Charges do not include a tip or gratuity as defined under State or federal law.

Under the updated Ordinance, Employers must provide clear notice to customers of the charges and its usage. Employers must share with employees how they distribute service charge proceeds, and must keep records of service charge revenue receipts and spending.

The ordinance prohibits retaliation against employees for rights protected under the minimum wage law, and provides that employers cannot reduce employees’ hours or other benefits to directly fund the wage increase.