CALIFORNIA—The State of California Franchise Tax Board announced that middle-income households who are eligible, may receive a one-time inflation relief payment.

Recipients must be California residents who lived in the state for at least six months in the year 2020 and must have filed a 2020 tax return for the year 2020, by October 15, 2021.

Individuals who meet the criteria can check the adjusted gross income section provided by CA Franchise Tax Board in the “What you may receive” section.

If the person filing a tax return was claimed as dependent in 2020, they do not qualify. Individuals who applied for an Individual Taxpayer Identification Number (ITIN), but did not receive it by October 15, 2021, must have completed their 2020 tax return on or before February 15, 2022.

The Federal Tax Bureau (FTB) partnered with Money Network to provide debit cards instead of paper checks to those who are eligible. Qualified individuals who e-filed (filed their taxes online) will likely receive their inflation relief payments by direct deposit.

Those who received an advance from the accountant who prepared their taxes or made arrangements for the tax preparer to be paid with funds from their tax return, may expect to be paid their inflation relief by debit card.

MCTR debit card payments for Californians who received GSS I and II are expected to be mailed between October 24, 2022, and December 10, 2022. The remaining debit cards will be mailed by January 14, 2023.

The amount received depends on income at the time residents filed their 2020 taxes.

Married couples filing jointly with an income of $150,000 or less with a dependent may receive $1050 or $700 without a dependent. Individuals with a total of income of $150,001-$250,000 are scheduled to receive $750 with a dependent or $500 without a dependent.

Those earning $250,000-$500,000 could receive payments of $600 with a dependent or $400 without a dependent.

Individuals who claimed an income of over $500,000 on their tax return do not qualify for inflation relief payments.

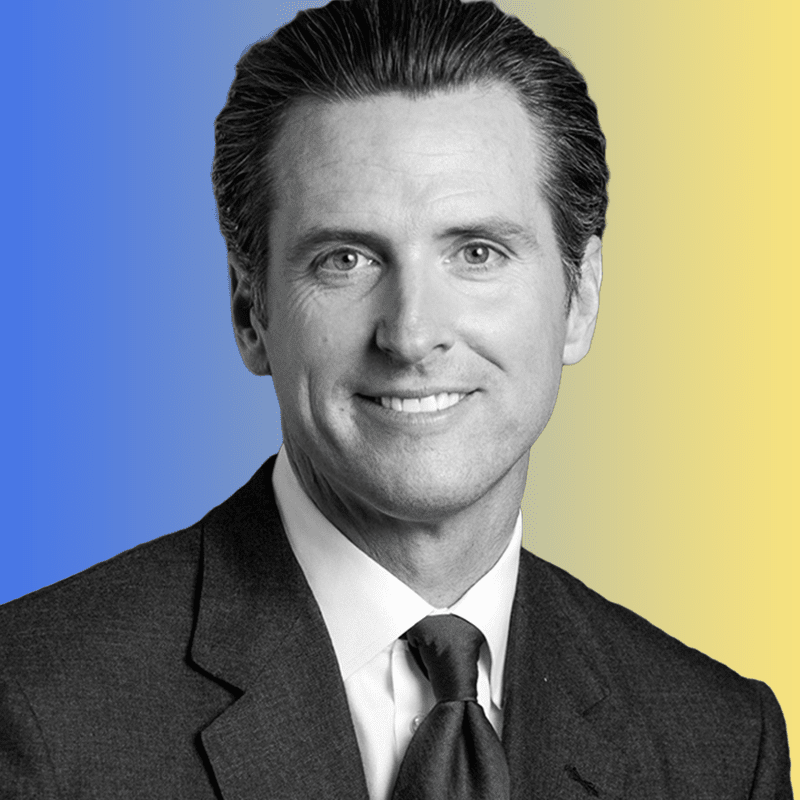

Governor Gavin Newsom who was proponent of stimulus relief checks, has pushed for the inflation relief checks.

According to reports, monies used for the Inflation Relief payments will be drawn out of California’s surplus funds or what is often referred to as a slush fund. It is money that has not been designated for any specific purpose.