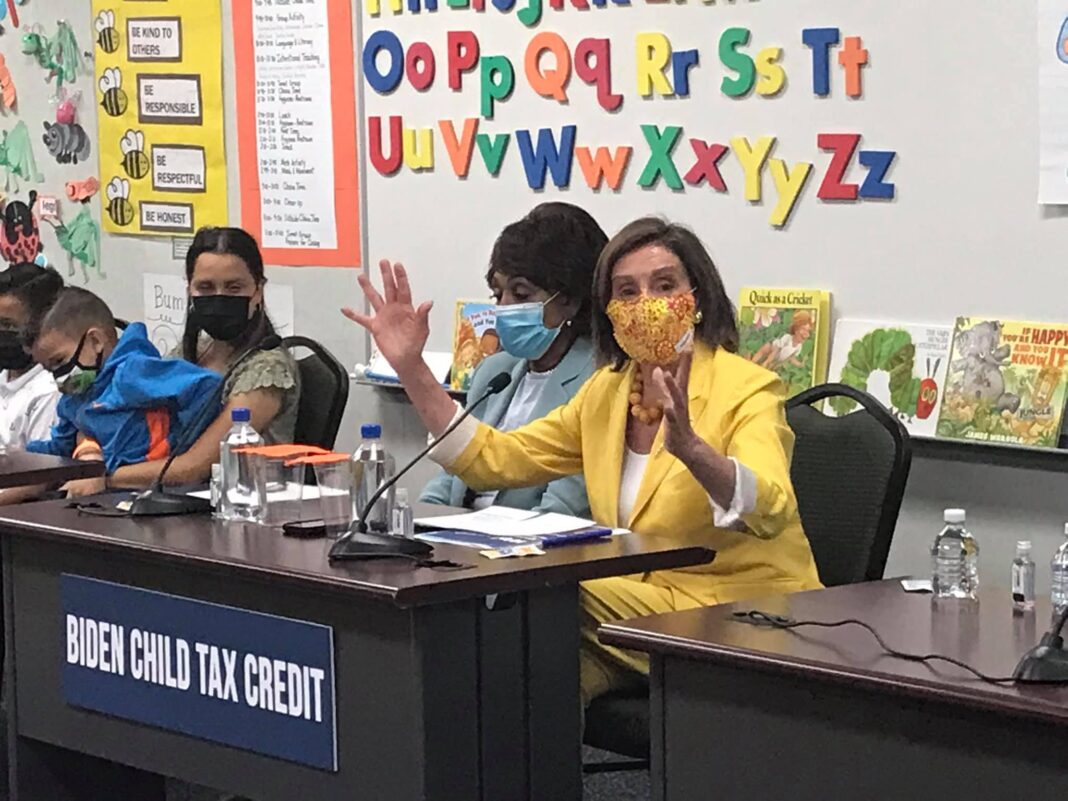

UNITED STATES—On Thursday, August 12, Speaker of the House Nancy Pelosi of California, Senate Majority Leader Chuck Schumer of New York, Senator Cory Booker of New Jersey, Congressman Ted Lieu of California and other Democrats in Congress announced the passage of the Child Tax Credit, which sends more money out to families with children within a certain income bracket.

What you need to know about the Child Tax Credit is listed below coming directly from the White House web page.

Deposits for Child Tax Credit are labeled for deposit “CHILDCTC.”

The deposit transactions will come with the company name of, “IRS TREAS 310.”

The White House Webpage reports that “as of July 15, most families are already receiving $250-$300 per child without having to take any action.”

Families with children between the ages of 6-17 years of age are receiving $250 per child.

Families with children under 6 years of age are receiving $300 per child. This information is coming directly from the White House webpage and may be found at,

https://www.whitehouse.gov/child-tax-credit/childctc/

Eighty percent of those who file income taxes with the IRS will receive these payments in their bank accounts through the end of 2021. Those who do not file with the IRS will receive paper checks by mail. The following message is from the White House webpage.

“The American Rescue Plan enacted these historic changes to the Child Tax Credit (CHILDCTC) for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit (CHILDCTC) for years and years to come. President Biden proposes that in his American Families Plan.”

The following is a timeline of scheduled payments and bills passed to offer economic relief during the affects of coronavirus.

On Friday, March 27, 2020 then President Donald J. Trump signed the CARES Act, a $2.2 trillion economic stimulus package into law. The first round of stimulus checks were issued to people earning $75,000 or less came in the form of a direct deposit into individuals bank accounts beginning April 11 and 12. Recipients received up to $1,200.

In December 2020, Trump signed off on a $9 billion coronavirus relief bill for qualifying individuals. This stimulus check went off those tax-paying individuals making $87,000 or less with an additional $600 tax credit per child available for those who applied. Both direct deposits and paper checks were sent out between December 29, 2020 and January 2021.

New President Joe Biden passed the $1.9 trillion American Rescue Plan which was signed into law March 11, 2021. These checks were in the amount of $1,400. were direct deposited between March 13-14. Reports indicate an additional 6-7 batches of checks went out in this same package as recent as April 30.

The information for individuals who did not pay taxes to receive a child tax credit is below.

2021 Child Tax Credit for Non-Filers

Senator Sherrod Brown of Ohio stated “every Democrat voted for the tax credit and every Republican voted against it.”

Republicans in Congress are concerned about how the debt will be paid back and have requested to stop government spending.